Nestle is one of the largest food enterprises in the world that have been able to take on every field of nutrition and reach outstanding annual monetary turnovers. With almost 500 factories across the globe, Nestle makes it evident that its large industrial background allows it to claim the title of one of the biggest manufacturing organizations that provide people with food all around the world (Biswas et al., 2013). With the help of its nearly perfect operations, Nestle managed to make its products available nearly everywhere, which also adds to the image of the company and makes its reputation even better. The dedication that Nestle puts into its products may be easily seen throughout their strategies and how they manage their stakeholders. For every consumer issue or aspiration, Nestle finds a way to implement its employees’ experience and create a solution that would be the most suitable and enhance the quality of life.

Irrespective of where a person lives, Nestle is entitled to providing them with food and beverage products of the highest quality and make sure that they can stay relevant to consumer needs in the area. With its headquarters being located in Switzerland, Nestle still manages to operate almost 400.000 workers globally (Navaneetha et al., 2017). This fact hints at a rather strong strategy that allows the company to make imperative decisions and successfully navigate through the market complexities with the help of competitive advantages that Nestle had been developing throughout its long history. A strong focus on research and development broadened the horizons of innovation for Nestle and showed the executive branch how to cover extremely wide geography while remaining efficient entrepreneurs. Significant corporate values became Nestle’s calling card, and there is no doubt that the company will be able to capitalize on its existing strengths in the future.

Features of Corporate-Level Strategies

Nestle’s corporate-level strategies define the company as great and help it overcome the success of its business units on a long-term scale. The idea here is that tactical decision-making and its strategic counterpart should be separated in order to help the executive board achieve an effective organisation and focus on the future of the company. Business unit operations, at the same time, will be assigned to the respective business units without putting a strain on the corporate centre. When looking at Nestle, one may see that the company effectively develops and follows its strategies as per the key five aspects such as positioning, planning, patterning, manoeuvring, and putting things in perspective (Smith, 2012). The key concern of Nestle is to develop a vision that is going to help the company achieve consumer contentment and remain in line with the original mission proposed by executives. Without the vision, none of the features of corporate-level strategies discussed below are going to function as expected. Therefore, Nestle’s intentions are to investigate the emerging markets and minimise the number of unplanned outcomes while calculating the market patterns simultaneously.

Nestle’s corporate-level strategies are always oriented toward stability and development, which makes it easy to conclude that the company’s willingness to become the best-branded manufacturer of foods and beverages in the world is an attempt to maintain high-quality standards and realise the original Nestle’s vision. The enterprise heavily competes in its areas of practice and tries to achieve unsurpassed results in all possible categories of manufacturing. This may be considered the key strategy that drives Nestle’s market orientation and creates room for potential improvements in terms of research and development (Sasson, 2016). An essential area of focus for Nestle is a healthier diet of its consumers that can be achieved with the help of the company’s products. Nestle also recurrently uses culturally sensitive advertising and adaptation of services to ensure that local consumers are going to support the proposed products. On many organisational levels, Nestle sustains its competitive advantages to engage in better production planning and revise its strategic business models in accordance with the ever-changing global marketplace.

Corporate-Level Strategies and Their Features

When attempting to retain its spot in the list of the top food and beverage manufacturers in the world, Nestle most often relies on three essential corporate-level strategies: advancement, stability, and cost reduction. As for the strategy of advancement, its features are most feasible because of the serious growth that Nestle recurrently experiences across more than 100 countries and 500 business units. The company’s strategic partnerships with investors and business associates significantly reduce the time required to advance and conquer new markets (Dhanesh and Sriramesh, 2018). The ultimate growth of Nestle may be established as both horizontal and vertical because the company manages to reach out to new target markets while also strengthening its operational position, respectively. The autonomy that Nestle has been able to achieve became one of its most recognisable features due to relentless business promotion and supply chain management. The company always aims to diversify and extend its portfolio to earn even more advantages that are competitive and help Nestle outrun its industry rivals.

The stability strategy is not used by Nestle as often as its advancement counterpart because there are certain market conditions that may lead the company to suspending its activities within an auspicious economic environment where the level of market saturation is too high and industrial growth is too weak to be recognised. Therefore, Nestle suspends its activities in unfavourable conditions to move forward more cautiously and achieve better outcomes by merely taking their time to wait for improvements. Even though corporate-level stability strategies lack the vigour characteristic of their advancement counterparts, the overall idea that Nestle recurrently pursues is that operational growth may not be possible within a business environment where conditions are unstable (Payaud, 2014). In turn, Nestle successfully extends its brand and expands corporate operations under advancement strategies after it has been able to save its resources with the help of corporate-level stability schemes.

The strategy that is the least often utilised by Nestle relates to cost reduction. The idea behind this strategy is that the corporation has to discard operations that do not contribute to its overall success while requiring serious monetary investments in quality management and research and development. This way, Nestle stays away from brands and products that display low performance and do not bring as much profit to the company as other initiatives (Pemberton, 2011). Cost reduction strategy also features access to a decreased marketing budget where Nestle is entitled to reduce the costs of its operations by any means. As a company aimed at attaining its vision, Nestle does not resort to cost-cutting initiatives too often to support its first-class manufacturing with strong quality control and timely feedback from consumers and employees.

The bottom line is that Nestle’s ability to achieve market domination is mostly related to its extensive customer base and the ever-growing portfolio. These two factors ensure that the corporation experiences non-stop financial growth and inflates its market share through the advancement strategies. The choice to pursue these strategies may be deemed as crucial for Nestle because it unlocks innovative prospects for the company and allows the executives to develop even more operations intended to help Nestle grow both horizontally and vertically. The enterprise’s competitive advantages are shaped with the help of the advancement strategy because the latter makes it possible to focus and narrow the target segment, lead the market in terms of costs, and differentiate effectively. Nestle’s lower-end supply chain became so successful mostly owing to the ability of the company’s management to control operating costs and ensure that the corporation is going to grow vertically in the case where it becomes more self-sufficient.

Porter’s Generic Strategies

For Nestle, Porter’s generic strategies stem from the concepts of cost leadership, differentiation, and strong focus. The rationale behind analysing these generic strategies is to make sure that each of them contributes to the enterprise’s unique vision and creates a unique business environment where improvements occur naturally. The numerous competitive advantages characteristic of Nestle’s corporate-level strategies, therefore, can be divided into three categories that are synonymous with the following Porter’s generic strategies.

Cost Leadership

The ultimate concept of a cost leadership strategy suggests that a company may develop a competitive advantage by reducing the cost of certain products that may also be provided by other manufacturers. Therefore, cost leadership may be considered the most common generic strategy used by Nestle. The essential idea behind cost leadership is that Nestle effectively targets the majority of middle-class customers, which allows the management to enlarge the market share without additional expenditures (Stobart, 2016). The corporation smartly approaches the required consumer market mix and targets the largest samples in every country. Due to the fact that the pricing factor is one of the most reliable in the business, Nestle capitalises on it in an attempt to cater to as many customers as possible when developing its pricing strategies for different communities. The efficiency of Nestle’s cost leadership may also be explained by how easily accessible are the company’s products all over the world. An exceptional level of consumer awareness makes it possible for Nestle to attain high sales and remain extremely competitive without introducing any critical changes.

On the other hand, the fact that Nestle pursues low-cost strategies may be a sign of the fact that it strives to improve its supply chain efficiency while reducing the production fees. There are multiple discounts offered by the company on a global scale that pave the way for the executives in terms of achieving sales objectives and managing the strongest aspects of rivalry. The most common outcomes of this approach are increased customer consumption and brand awareness (Wilenius, 2017). The generic strategy of cost leadership offers Nestle many profits that cannot be achieved by other corporations that do not benefit from exceptional brand recognition and an extensive customer base. Constant encouragement established by Nestle makes its products more accessible and highlights the need for additional strategies that could be utilised to sustain the existing competitive advantages and reach out to even more potential consumers willing to invest in the corporation.

Differentiation

Another Porter’s generic strategy that may be reviewed within the framework of the current paper is differentiation. Nestle combines the cost leadership strategy with its differentiation counterpart to ensure that it will be sufficient for the process of attaining competitive growth and sustaining the positive change. The key rationale for the utilisation of differentiation is that the corporation comes up with many unique product features that cannot be found in their rivals and appeal to the extending customer base with the exquisite characteristics of production. The company knowingly addresses the growing concern for healthy eating patterns, which allows Nestle to innovate by paying more attention to what is interesting to the customers. One of the best examples of differentiation may be that Nestle often transforms its product line to adjust to the consumers and competitors without altering the organisational objectives and the vision (Botero et al., 2011). As a company that perfectly combines cost leadership and differentiation, Nestle was able to build a strong follower base that displays loyalty when interacting with the brand, both offline and online. This means that Nestle’s offerings easily outrun any alternatives due to the uniqueness of the corporation’s positioning.

Nestle is a company with a strong grip that does not shy away from differentiation because it helps reduce the pressure applied to the corporation by other competitive brands. The enterprise never fails to endorse its products with the help of celebrities in order to differentiate and appeal to specific market segments. As one of the long-standing moguls, Nestle has the experience required to establish a robust presence in the market. Its communication strategy is also a means of differentiation because it highlights Nestle’s customer-centredness and the willingness to think out-of-the-box when it comes to the ways of leaving consumers contented (Patrizia and Gianluca, 2013). Even Nestle’s brand logo stands out by a notch, as the customers recurrently recognise it even after numerous revisions that had occurred since the advent of the corporation. The strongest differentiating factor, though, is Nestle’s thoroughness in protecting the brand and what the latter means for the customers. In-house innovation augments the company’s competitive advantages and makes it easier for the management to explore new markets and match the exclusive needs of consumers.

Focus

The last Porter’s generic strategy that Nestle recurrently uses is the focus strategy. It narrows down the segment that the company expects to target and then distillates the assets that may be expected to help it gain a competitive advantage in the long run. Nestle is a strong niche player, and it allows the management to play the segment card and narrow its operations to offer the best possible value for the lowest available price. Even though Nestle’s products are not always related to the low-cost category, the corporation’s attempts to serve the needs of certain consumers turn out to be successful in most cases. The focus strategy is adopted by the executives when it is required to design and deploy a product that is fully aligned against the requirements set by the consumers (Saunders, 2011). Continuous change that Nestle nurtures is a clear sign of the fact that consumer expectations play an important role in the company’s operations, as the ability to provide maximum value for a limited amount of money is a perfect branding strategy for such a household name as Nestle.

Nestle: Examining the Suitability of Strategies

Nestle’s Remote and Operating Environments

PEST Analysis

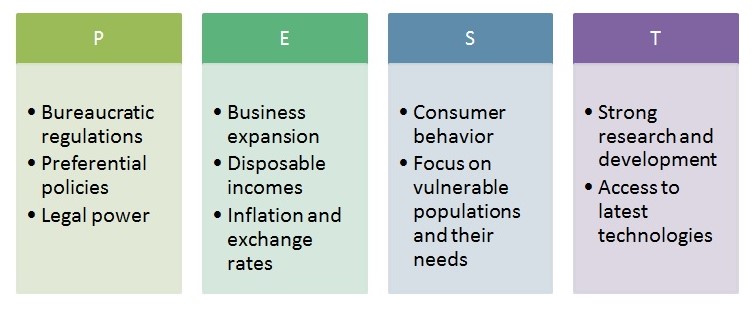

The political aspect is rather important for Nestle because there are numerous bureaucratic regulations that have to be addressed by the company in order to maintain its international business operations and follow the existing taxation policies (see Figure 1). The corporation’s targeted markets are recurrently exposed to political stability and generate steady sales irrespective of the political climate. Nestle’s management respects the need to follow regulations and does not interfere with the strict certification of raw materials. On the other hand, organisational performance displayed by the corporation may be contingent on flawless strategic planning that is also aligned against disclosures on bribery and fraud (Donze and Kurosawa, 2013). Nestle masterfully protects itself from negative political backlash with the help of strong initiatives that follow suit and do not leave the enterprise releasing preferential policies that would put customers or any other stakeholders at a disadvantage. Accordingly, Nestle efficiently explores new markets because it possesses enough legal power to expand its growth worldwide without breaking any laws.

From the economic standpoint, Nestle achieves varied successes depending on the country where it deploys its operations. The biggest challenges that the corporation has to take on when positioning itself in the market are the rates of interest and inflation and exchange rates. The problem with these elements is that they significantly affect business strategies proposed by Nestle and slow down the decision-making process because of slower market entrances (see Figure 1). For particular regions, Nestle’s product deployment could take longer because of the differences in consumers’ purchase power and the amount of disposable incomes (Olawepo and Ibojo, 2015). Further expansion of the business is always an option for the corporation because the latter may easily refocus its operations in the case of economic issues and shift its operations to much more profitable regions in the case of a complex scenario. Nevertheless, the number of middle-class individuals increases across the world, which means that disposable incomes in different economies grow relentlessly and create more room for Nestle to innovate and appeal to a diverse customer base.

Nestle perfectly captures the socio-cultural elements of its business initiatives as well, which is evident due to the global market successes achieved by the corporation throughout all the active years in the field. The company carefully addresses consumer behaviour and tries to improve its operational efficiency through the development of high-quality products and adherence to socio-cultural characteristics of communities that serve as the objectives for organisational incentives (see Figure 1). One of the best examples of how Nestle caters to the socio-cultural roots of customer-company relationships is its decision to introduce small packets of chicken bouillon across lower-income groups in Africa to help them cook the whole meal and not simply use a small cube of a flavour enhancer to improve the existing dish (Hanifan, Sharma and Mehta, 2012). Not only Nestle was able to customize an obtainable product, but also make it much more relevant for the local population and their consumption habits.

The ultimate element of the PEST framework is the technological advancement of an organisation. As per the information from the literature, Nestle has one of the most viable research and development departments in the industry that focuses on all possible improvements in the area that could help the corporation gain more competitive advantages than their rivals (Backer, 2010). The extensive range of possible products makes it easier for Nestle to remain highly consistent and produce large amounts of high-quality products that appeal to many customers and target new markets effortlessly (Paswan, 2013). The enterprise’s strong capacity makes it evident that the Nestle’s research praises nutritious, healthy food and wants customers to maintain their vigorous lifestyles. The current technological advancement makes it possible for Nestle to improve existing products and create more room for the new product lines (see Figure 1). The notions of e-commerce and online stores seriously influence the company’s presence on the Internet and make it easier for the food and beverage mogul to compete on a world-class level and gain more advantages than the rivals.

Boston Matrix

There are numerous brands that are owned by Nestle. With so many products and services that the corporation offers to its customers, it may be safe to say that there are just as many markets that have to be approached differently. There are several large subcategories that have been picked by the author of the current paper to explain how the Boston Matrix could be utilised to support the idea that Nestle’s strategies are suitable enough to cover the company’s rivalry and the need for more competitive advantages. The flagship categories where Nestle wins big are baby foods, chocolate items, cereals, and dairy products. Some of the less popular products are bottled water, ice cream, and different drinks. The Boston Matrix will be utilised to place these products under the four key categories.

The so-called Cash Cows of the food and beverage industry tycoon are baby food products and chocolate brands. The main reason why these may be considered the most important is that they have an almost perfect global presence in the market and add points to Nestle’s image. Two other important brands that cannot be overlooked are Cerelac, Nido and Kit Kat (Nisa and Ravichandran, 2013). The former is one of the most well-known child food items that also features a worldwide presence, while Nido is an up-and-coming nutritional milk brand that quickly gained its loyal followers all over the world. As for Kit Kat, there are numerous manufacturing plants that have been set up to produce more than 1 billion chocolate bars per annum (see Figure 2). These results show that Nestle cares a lot about its Cash Cows and focuses on the possibilities of improving them.

The Stars represent the products that Nestle believes to have enough potential to penetrate even more markets in the future. One of the best examples may be the new lines of frozen products that Nestle advertises as an opportunity to get in line with the cooking market across the United States. The biggest Star brand that Nestle expects to continue pushing forward is Stouffer (Mahalakshmi and Karthiga, 2020). The corporation’s frozen pizzas have been met with much enthusiasm and may be expected to achieve an even greater market share in the future if Nestle will capture its opportunities and act swiftly (see Figure 2).

The so-called Dogs tend not to bring a lot of revenue to Nestle, and their turnaround is a rather complex process that puts a strain on the company’s budget. For the most part, Dogs represent the soon-to-be discarded products that have to be ignored by Nestle if the latter expects to achieve larger profits and expand its customer base (see Figure 2). The biggest Dog for Nestle is its willingness to support the pharmaceutical business and invest in medicine-related initiatives (Shuman, 2013). Instead, the corporation should put the emphasis on the majority of its nutritional products and make sure to appeal to customers with the help of food and beverages and not pharmaceutics.

The Question Marks for the company are those products that bring uncertainty to the table and make it harder to decide whether Nestle has to develop a new product line or not. The idea behind Question Marks is that they can either become Cash Cows or Dogs, depending on how the company treats them (see Figure 2). Given to the situation in the current global market, it may be concluded that Nestle Noodles and Maggi can be outlined as the Question Marks (Abdul Hamid, Atan and Md Saleh, 2014). Even though the corporation considers the cultural elements, it is not always able to cater to the majority of its consumers, which negatively affects the enterprise’s capability of predicting the possible market transformations.

Nestle’s Capabilities

SWOT Analysis

The biggest strength of Nestle is its extensive portfolio that the company continues to enlarge annually in order to appeal to every category of consumers and make the best use of the location of manufacturing. Despite the fact that there are numerous potential rivals, Nestle’s competitive advantages help the mogul lead the way and squash the rivals. Another strength is that Nestle operates a large number of solid suppliers from all over the world (see Figure 3). Not only this brings more sustainability to the table but also reduces the number of potential supply chain challenges that Nestle might have to resolve on a long-term scale (De Wit and Meyer, 2010). Numerous awards for an exceptional level of sustainability prove that Nestle’s strategic management is impeccable. This international image makes it possible for the food and beverage mogul to expand its market influence and consumer awareness.

One of the crucial weaknesses characteristic of Nestle is the fact that there were several times when the company was found to be unethical in terms of marketing. Occasionally, the corporation was found to be manipulating its data sources multiple times, which also means that some of the company’s products may not be worth the image that Nestle created for them. Another issue with the enterprise is that its advertising campaigns sometimes do not fall under the guidelines that Nestle itself promoted earlier (Boyd, 2012). On the other hand, there were situations where the corporation was found to be selling contaminated food and utilising child labour, which also sends the author of the current paper back to an idea that Nestle benefits from unethical practices (see Figure 3). There are also weaknesses right inside the supply chain of Nestle, as there were products that had to be recalled in the past due to the flawed packaging.

There is only one serious opportunity that Nestle should explore in order to be able to respond to criticism and outrun its opponents. The company should focus on thorough market penetration and continue pushing its bottled water, coffee, and child food item agendas (see Figure 3). Both developed and emerging markets are going to benefit from the opportunity because the global market share is relatively unstable in these areas (Vander Schee et al., 2011). Increasing consumer awareness may help Nestle make the best use of health-conscious behaviours and introduce an extended number of items intended to help customers maintain a healthy lifestyle.

There are three essential threats that have to be considered by Nestle when continuing its worldwide operations. The first one is the presence of multiple rival companies that carefully align their strategies to avert Nestle from leading the market in sales and any other categories. Some of these companies are Danone, Kellogg’s, Heinz, and Kraft Foods. On the other hand, Nestle should be vigilant about its legal challenges that may also stem from the ethical issues discussed in the paragraph on the corporation’s weaknesses (see Figure 3). The company has been through multiple litigation cases and has a history of being sued for utilising child labour (Myers, 2020). Ultimately, the threat that Nestle might have to face in the future is the increasing cost of water production that remains unstoppable due to the scarcity of water worldwide. This would also damage the enterprise’s profit margins in the future.

Nestle’s Stakeholder Expectations

The first idea that Nestle has to follow when interacting with the stakeholders and trying to meet their expectations is to satisfy the consumers by building more trust between the corporation and its followers. Senior management recurrently addresses the possibility of engaging purchasers in the process of strategic development in order to elaborate action plans and policies that are perfectly in line with what is of interest to customers and not the corporation itself (Ma et al., 2010). In a sense, the ability to satisfy customers is essential for Nestle because it serves as one of the shortest pathways toward improved engagement and predictable consumer expectations. There are multiple fundamental issues that yet have to be resolved by the company, so it may be reasonable for the management to improve their products with the help of high-quality reputation and respect from customers.

On the other hand, there are stakeholders that have to be managed by Nestle if the corporation expects to build positive relationships with the remainder of the market and achieve positive outcomes. The latter may also be associated with different certification bodies and governments, as the numerous foundations and academies could invest in Nestle as well (Boachie-Mensah and Dogbe, 2011). This means that the multi-stakeholder partnerships are essential for the enterprise, as otherwise, it would not have enough room to implement its long-standing market-leading products within developing environments.

Another group of stakeholders are those who also serve as independent facilitators similarly to Nestle. As the corporation is going to monitor them, it will have more chances to prioritise its tasks properly and discuss the most important things with the stakeholders in a manner where the expectations will also reach the public affairs unit (Memon and Tahir, 2012). Nestle engages in perfect stakeholder collaborations because it shares supportive materials with all the required interested parties and facilitates the communication process. The essential objective here that the corporation tries to pursue is the development of honest dialogue between Nestle and its followers. The company recurrently gives a chance to every voice and works independently to hold the most valuable conversations on issues that are of interest to different groups of stakeholders.

Ultimately, there is a group of stakeholders that have to be informed by Nestle first in order to act based on feedback in the future. The fact that loyal followers get an opportunity to speak out serves as one of the key drivers of organisational change at Nestle. There have been numerous initiatives that appeared as a result of the company being able to inform its stakeholders and ensure they grasp the meaning of what has been communicated to them (Mitra and Neale, 2014). In turn, thorough attention toward communication and feedback allowed Nestle to achieve an unsurpassed level of greatness when it comes to corporate-level strategies.

Conclusion and Recommendations

Based on the information collected within the framework of the current paper, it may be concluded that the corporate strategies of Nestle are all suitable and relevant. The first reason why this is true is the ubiquity of multiple growth platforms that the enterprise utilises relentlessly when extending the company’s portfolio and generating more profits. There are numerous emerging markets (such as wellness or healthy nutrition) that can be explored by Nestle to become a premium-level manufacturer that has no obstacles on the way to worldwide market domination. The obvious advantage of existing advancement strategies is that the corporation’s initiatives are supported on many levels from consumers to top managers. Such thorough following might help the board identify other potential growth models and make the best use of available assets.

Differentiation is also a crucial corporate-level strategy that is suitably utilised by Nestle because the multiple product lines increase the corporation’s flexibility and create additional niches that can be later used to eliminate the most viable rivals. Multiple growth platforms characteristic of the advancement strategy may be useful in the case of differentiation, too. Nestle might be able to acquire additional assets and spark extensive internal growth that is going to cause the market to transform under the influence of Nestle’s attempts to differentiate. This would make the enterprise much more profitable and growth-prone, which also validates the idea that differentiation is a suitable corporate-level strategy for Nestle. Such flexibility might help the business overcome the issue of not being able to pay enough attention to the area of pharmaceutics and reallocate the resources in a different way that would contribute to proper internal growth.

The focus strategy also reaches a rather high level of suitability because it goes beyond the majority of basic strategies that solely focus on acquisitions and weak differentiation. As Nestle chooses to narrow down the area of its attention, it helps the executives to overcome the need to apply mere internal growth to succeed greatly. In other words, additional acquisitions and investments would help Nestle gain more power in those areas where it is currently lacking. The company’s long-standing commitment to high-quality products would be stretched out to an extent where the corporation would have a chance to drop any of its underperforming products or services at any time and evade serious performance shortages. In the future, a combination of all three strategies might lead Nestle to numerous positive outcomes linked to the community’s health, nutrition, and wellness.

Reference List

Abdul Hamid, F. Z., Atan, R. and Md Saleh, M. S. (2014) ‘A case study of corporate social responsibility by Malaysian government link company’, Procedia-Social and Behavioral Sciences, 164, pp. 600-605.

Backer, E. (2010) ‘Using smartphones and Facebook in a major assessment: the student experience’, E-Journal of Business Education & Scholarship of Teaching, 4(1), 19-31.

Biswas, A. K. et al. (2013) Creating shared value: impacts of Nestlé in Moga, India. New Delhi: Springer.

Boachie-Mensah, F. and Dogbe, O. D. (2011) ‘Performance-based pay as a motivational tool for achieving organisational performance: an exploratory case study’, International Journal of Business and Management, 6(12), pp. 270-285.

Botero, M. E. et al. (2011) ‘CSR practices in the coffee industry: a preliminary review of Kraft Foods, Nestlé and Starbucks’, Revista de Negocios Internacionales, 4(2), pp. 30-44.

Boyd, C. (2012) ‘The Nestlé infant formula controversy and a strange web of subsequent business scandals’, Journal of Business Ethics, 106(3), pp. 283-293.

De Wit, B. and Meyer, R. (2010) Strategy: process, content, context: an international perspective. New York: Cengage.

Dhanesh, G. S. and Sriramesh, K. (2018) ‘Culture and crisis communication: Nestle India’s Maggi noodles case’, Journal of International Management, 24(3), pp. 204-214.

Donze, P. Y. and Kurosawa, T. (2013) ‘Nestlé coping with Japanese nationalism: political risk and the strategy of a foreign multinational enterprise in Japan, 1913–45’, Business History, 55(8), pp. 1318-1338.

Hanifan, G. L., Sharma, A. E. and Mehta, P. (2012) ‘Why a sustainable supply chain is good business’, Outlook, 3, pp. 1-7.

Ma, B. et al. (2010) ‘The effects of product-harm crisis on brand performance’, International Journal of Market Research, 52(4), pp. 443-458.

Mahalakshmi, V. and Karthiga, M. S. (2020) ‘Financial performance of Nestle India Limited’, Studies in Indian Place Names, 40(19), pp. 1-9.

Memon, M. A. and Tahir, I. M. (2012) ‘Performance analysis of manufacturing companies in Pakistan’, Business Management Dynamics, 1(7), pp. 12-21.

Mitra, A. and Neale, P. (2014) ‘Visions of a pole position: developing inimitable resource capacity through enterprise systems implementation in Nestlé’, Strategic Change, 23(3-4), pp. 225-235.

Myers, A. (2020) ‘Nestlé tackles child labour for 100% sustainable cocoa: good governance’, FarmBiz, 6(3), pp. 34-35.

Navaneetha, B. N. et al. (2017) ‘An analysis of cost volume profit of Nestlé limited’, Management and Administrative Sciences Review, 6(2), pp. 99-103.

Nisa, S. and Ravichandran, N. (2013) ‘Trade policies and their impact on business models: a comparative study’, IUP Journal of Business Strategy, 10(1), pp. 20-30.

Olawepo, G. T. and Ibojo, B. O. (2015) ‘The relationship between packaging and consumers purchase intention: a case study of Nestlé Nigeria product’, International Business and management, 10(1), pp. 72-81.

Paswan, R. K. (2013) ‘Analysis of solvency of selected FMCG companies in India’, Global Journal of Management and Business Studies, 3(4), pp. 401-406.

Payaud, M. A. (2014) ‘Marketing strategies at the bottom of the pyramid: examples from Nestle, Danone, and Procter & Gamble’, Global Business and Organizational Excellence, 33(2), pp. 51-63.

Patrizia, G. and Gianluca, C. (2013) ‘Stakeholder engagement between managerial action and communication’, Annals of the University of Oradea, Economic Science Series, 22(2), pp. 97-105.

Pemberton, M. (2011) ‘Playing fair [trade] with Nestlé: the evolution of an unlikely partnership in the conventional coffee market’, Studies in Political Economy, 87(1), pp. 65-92.

Sasson, T. (2016) ‘Milking the Third World? Humanitarianism, capitalism, and the moral economy of the Nestlé boycott milking the Third World?’, The American Historical Review, 121(4), pp. 1196-1224.

Saunders, S. G. (2011) ‘Ethical performance evaluation: an extension and illustration’, European Business Review, 23(6), pp. 561-571.

Shuman, M. (2013) Going local: creating self-reliant communities in a global age. New York: Routledge.

Smith, E. (2012) ‘Corporate image and public health: an analysis of the Philip Morris, Kraft, and Nestle websites’, Journal of Health Communication, 17(5), pp. 582-600.

Stobart, P. (2016) Brand power. New York: Springer.

Vander Schee, B. A. et al. (2011) ‘Nestlé: brand alliances in developing markets’, Journal for Advancement of Marketing Education, 18(1), pp. 32-39.

Wilenius, M. (2017) Patterns of the future: understanding the next wave of global change. New York: World Scientific.